Find out how your business can benefit from adding this unique insurance offering for your employees.

Key takeaways:

- As job markets become increasingly competitive, additional employee benefits like legal insurance can give businesses a distinct advantage.

- Benefits of legal insurance for employees include assistance with family law issues, real estate, estate planning and more.

- Offering these benefits can grant your business a competitive edge.

Foundational employee benefits – including health insurance, retirement accounts, paid time off and wellness programs – are important to your staff. But as the job market becomes more competitive, you should ensure what you offer your employees includes what’s trending; SHRM found that 60% of employees say their benefits contribute to job satisfaction.

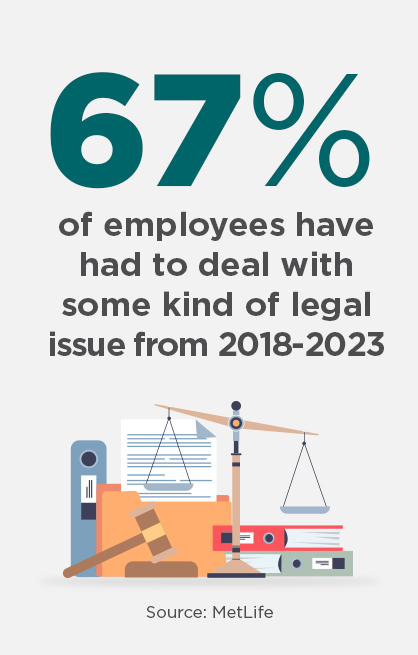

Legal insurance is a good place to start. MetLife research found that 67% of employees have had to deal with some kind of legal issue from 2018-23, meaning they need legal support to work through these issues. This is why over 75% of Fortune 100 companies and 55% of Fortune 500 companies provide some kind of legal insurance plan to their employees (as of 2021).

Find out more about how legal insurance works and the benefits your company will see from offering it to employees.

How Legal Insurance Works

Say an employee is dealing with a personal legal issue outside of work, like a civil lawsuit or a divorce. Legal insurance coverage provides access to legal services through a network of attorneys at a lower cost than they would otherwise pay.

Legal insurance could help employees with various legal challenges they may face in their personal lives, including family law issues like divorce or child custody, real estate matters, civil actions, identify theft, estate planning, traffic violation issues and much more. Insurance typically covers basic legal services like reviewing documents, representation in court and general counsel.

Providing this voluntary benefit to employees gives them the option to prepare for their future, whatever it may bring, with some extra security.

Benefits of Offering Legal Insurance Benefits to Employees

In today’s job climate, where employees are looking for better salaries and employee benefits and more satisfying positions, your company need to keep up. Legal insurance can make a big difference, helping your employees improve their quality of life while you stay competitive as an employer.

Consider these key benefits of legal insurance:

Access to Legal Help

A big issue for Americans is the ability to pay for the legal services they need. According to a report from the Legal Services Corporation, low-income Americans can’t get the legal help they need for 92% of their substantial civil legal problems. Offering legal coverage helps your team members cover these costs.

Affordability

Legal insurance isn’t nearly as expensive as most health insurance plans. It varies from provider to provider, but premiums can be as low as $10 per month, up to about $25 per month. Compare that to the average hourly attorney rate of nearly $400.

Help with Real Estate Transactions

Buying a home is a common goal – around 4 in 10 Americans said they’re planning to buy a home in 2024. A big part of that process can be working with an attorney to guide them through and ensure their best interests are being represented, which is an important step, especially for first-time home buyers.

Help with Family Law Issues

Legal issues concerning family law impact millions of people every year. These issues are related to marriage and families and include divorce, child custody battles, alimony, division of property, domestic violence, adoption and others. Any time an employee deals with these emotionally distressing issues, legal insurance helps them resolve the matter with the help of the legal professional of their choice.

Help with Estate Planning

Estate planning can be complicated. Employees may want to work with an attorney to create wills, trusts, a power of attorney, advanced health care directives or retirement accounts. These steps are critical for workers to protect their families’ assets and set up a plan for later in life.

Assistance with Disputes

Legal conflicts and lawsuits can take a toll on employees, especially when they don’t have help to resolve them. They can become expensive fast, as attorneys may charge hundreds of dollars per hour to work on a complex case, not to mention the stress and loss of time spent on these issues. Legal insurance helps your employees avoid dealing with disputes on their own.

Staying Competitive as an Employer

Employers should do everything they can to stay competitive, especially in a job market like ours, where top talent increases its expectations and requirements each year. Providing legal insurance helps you show a new level of employee support, offering a benefit that other companies aren’t offering.

How a PEO Helps You Gain Access to

Top-Notch Legal Insurance

Working with a professional employer organization (PEO) can give you access to exclusive legal insurance programs and rates that other businesses don’t have. PEOs’ group buying power allows them to negotiate competitive prices for best-in-class legal insurance.

PEOs also deliver one-on-one services with seasoned benefits and legal experts to help you manage and administer this benefit.

Contact PrestigePEO today to learn how to add legal insurance to your employee benefits mix.