Small group health insurance premiums are expected to rise this year, presenting both a challenge and an opportunity for brokers. The median proposed premium increase is around 11%. Key factors driving the increase include medical inflation, increased healthcare utilization and regulatory pressures.

The increasing costs of medical services and prescription drugs continue to contribute to rising medical inflation. The complexity and cost of new medical technologies and treatments exacerbate this trend.

Moreover, as more individuals utilize healthcare services, overall claims costs rise, further impacting small group premiums. This increase in utilization can be attributed to an aging population, greater awareness of health issues and more comprehensive coverage options that encourage people to seek care. Regulatory changes also complicate providing health benefits, and maintaining compliance with evolving healthcare laws and mandates uses administrative resources, which raises costs for businesses.

What does this mean for you and your clients? PrestigePEO understands what you’re dealing with, and understanding these dynamics is necessary to explain the reasons behind premium hikes to your clients. Providing a clear, data-driven narrative means you help clients see the broader market forces at play and the necessity of exploring alternative solutions to mitigate these rising premiums.

In this article, you will see how:

- Strategic, data-backed insights to help you explain to your clients why health insurance premiums are increasing in the small group market.

- Partnering with PrestigePEO offers stability through pooled plans, which spread risk across multiple employers. This translates to consistent renewals and large-group pricing power.

- PrestigePEO supports brokers with dedicated service teams, transparent reporting and co-branded tools, enhancing client relationships and protecting your book of business.

Why Traditional Small-Group Insurance Models Fall Short

The small-group insurance model often falls short in several critical areas, making it less effective compared to larger group plans or alternative models. This is what you and your clients are running up against:

Higher Premiums

Smaller businesses frequently encounter significantly higher per-employee health insurance costs than their larger counterparts. This is because the risk is distributed across a smaller pool, leading to greater variability in healthcare usage and costs. Insurers, in turn, mitigate this risk by imposing higher rates for small group premiums.

Limited Bargaining Power

Unlike large corporations, smaller employers generally lack the negotiating clout needed to secure favorable terms with insurers. They are often confined to rigid, “take-it-or-leave-it” plans, with little opportunity for customization or cost negotiation. This lack of flexibility can result in plans that do not fully meet the needs of the business or its employees.

Adverse Selection and So-Called "Death Spirals"

Adverse selection occurs when small businesses with healthier, lower-risk employees opt for alternative, medically underwritten options, such as level-funded plans. Unfortunately, as you may know, this leaves the standard small-group market with a higher concentration of sicker or older individuals. This creates a “death cycle” of rising premiums and falling enrollment that can collapse an entire insurance plan.

Lack of Flexibility and Tailored Solutions

The traditional small-group model often employs a one-size-fits-all approach, which fails to address the diverse and specific needs of a varied workforce or industry.

Regulatory Complexities and Mandates

State-specific mandates and taxes contribute to increased premiums and administrative burdens, which particularly complicate compliance for businesses operating in multiple states. Navigating these regulatory complexities can be challenging for small businesses, adding to their operational strain.

Declines in Enrollment

The persistent challenges of the small-group insurance model have led to a steady decline in market enrollment over recent years. Employers are choosing to self-insure, utilize Individual Coverage Health Reimbursement Arrangements (ICHRA) or drop coverage altogether, pushing employees into the individual market.

These factors mean that many businesses struggle to provide affordable, competitive health benefits, which can significantly impact their ability to attract and retain employees. As a result, businesses are increasingly seeking alternative solutions that offer greater stability, flexibility and cost-effectiveness.

Recognizing these limitations and seeking innovative solutions will help you provide more stability and predictability for your clients. By moving beyond traditional models, you can offer clients access to more competitive pricing and comprehensive employee benefits, ultimately enhancing their value proposition.

The PEO Advantage: Stability Through Scale

Partnering with a Professional Employer Organization (PEO) like PrestigePEO provides your clients stabilized costs without sacrificing employee benefit quality. By pooling plans across multiple employers, PrestigePEO spreads risk and delivers consistent renewals, providing a level of stability that small groups cannot achieve on their own.

This model allows you to offer your clients access to large-group pricing power typically reserved for larger employers. Partnering with us ensures that your clients benefit from top-tier carriers and comprehensive benefit structures, all while maintaining cost stability.

The pooled plan model not only relieves the impact of medical inflation and utilization increases, it also provides a buffer against market volatility. By spreading risk across a larger pool of participants, PrestigePEO negotiates more favorable terms with insurers, resulting in more predictable and manageable small group premium growth.

PrestigePEO helps you protect and grow your book of business by offering your clients access to pooled plans, large-group pricing power and ongoing compliance and service support.

PrestigePEO’s Value: Protect and Grow Your Book

PrestigePEO is not an administrative vendor; it is a strategic benefits partner that empowers brokers to protect and grow their books of business. Through dedicated service teams, transparent reporting and co-branded client tools, we support you in maintaining consultative trust with your clients. By offering proactive, value-driven solutions, you can strengthen your client relationships and enhance your reputation as a trusted advisor.

The integrated compliance and service support we provide alleviates the burden on businesses, allowing them to focus on their core operations while enjoying robust health insurance offerings. This ensures that your clients receive not only cost-effective health benefits but also the administrative and compliance assistance necessary to navigate the complexities of today’s regulatory environment.

Our dedicated service teams work closely with you to deliver tailored solutions that meet your client’s needs. This personalized approach fosters strong relationships, enhancing client satisfaction and loyalty. By providing transparent reporting and co-branded client tools, PrestigePEO enables you to demonstrate the tangible value we bring to your clients, reinforcing our role as strategic partners.

Proof in Practice: Pooled Plan Outcomes vs. Small-Group Rate Trends

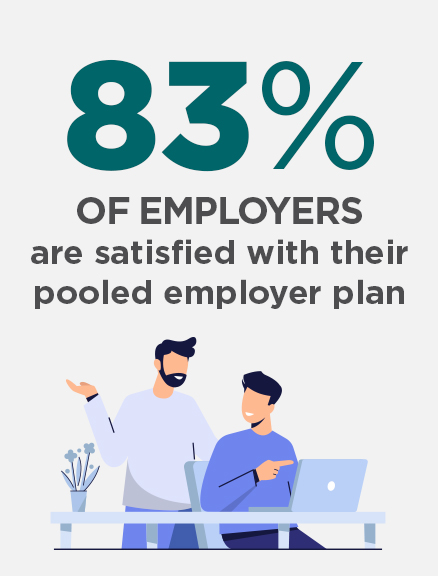

Data consistently shows that pooled plans offer greater stability compared to traditional small-group rate trends. A recent study reveals that 83% of employers are satisfied with their pooled employer plan. Additionally, survey respondents noted a 40% increase in satisfaction with their adviser after joining the plan. While small group premiums are projected to rise by double digits, pooled plans have demonstrated more predictable and manageable renewal rates.

Consider a scenario where a small business faces a potential 11% increase in premiums under a traditional model. By transitioning to a pooled plan with PrestigePEO, that increase could be significantly reduced, offering a more sustainable and predictable cost trajectory. This tangible difference underscores the value of providing cost-effective solutions that do not compromise on benefit quality.

Being armed with this data allows you to confidently present the PrestigePEO model as a strategic tool for cost containment and client retention. This difference is what keeps a renewal discussion from becoming a difficult conversation. By illustrating the relative stability of pooled plans, you will help clients understand the long-term benefits of partnering with PrestigePEO.

Your Playbook for Renewals

As you prepare for renewals, there are several actionable strategies you can employ to discuss the benefits of the PrestigePEO model with your clients:

- Educate clients on market dynamics: Clearly explain the factors driving premium increases and how PrestigePEO addresses these challenges. Use data and real-world examples to illustrate the impact of medical inflation, utilization and regulatory pressures on small-group premiums.

- Highlight cost stability: Emphasize the stability and predictability of pooled plans compared to traditional small-group models. Demonstrate how pooling risk across multiple employers can lead to more consistent renewals and reduced volatility.

- Showcase large-group pricing power: Illustrate how clients can access top-tier carriers and benefit structures through PrestigePEO. Highlight the advantages of large-group pricing power and the ability to offer comprehensive employee benefits at competitive rates.

- Reinforce the value of integrated support: Highlight the comprehensive compliance and service support that PrestigePEO provides, relieving administrative burdens for clients. Emphasize the value of having a single point of contact for employee benefits administration, HR and

- Share success stories: Tell success stories and detail case studies of clients who have benefited from the PrestigePEO model. Use these examples to build credibility and demonstrate the real-world impact of partnering.

By adopting these strategies, you’ll effectively communicate the value of a pooled plan model to your clients, ensuring they are well-prepared for the upcoming renewal season. By positioning yourself as a strategic advisor, you not only stabilize client costs but also strengthen long-term relationships, ultimately protecting and growing your book of business.

To see how PrestigePEO can help you stabilize client costs and strengthen long-term relationships, reach out today to explore the benefits of our pooled plan model. Let us support you in delivering exceptional value to your clients while navigating the complexities of the health insurance market. With PrestigePEO, you can confidently offer your clients a strategic solution that balances affordability, benefit quality and compliance peace of mind.