COBRA compliance is mandatory and missing a step could cost your business. Learn how small and medium-sized businesses can meet requirements, avoid penalties, and support employees with expert guidance from PrestigePEO.

If you’ve ever scrambled to issue a COBRA continuation coverage notice on time or questioned whether your small or medium-sized business (SMB) is meeting federal compliance requirements, you’re not alone. COBRA coverage is legally required, but often confusing, time-consuming and risky for employers who don’t have dedicated HR or legal teams.

This article breaks down exactly what you need to know about COBRA compliance, helping you avoid costly mistakes while protecting your employees and your business.

You’ll walk away with a clear understanding of:

- What COBRA coverage is and who qualifies

- The most common COBRA-qualifying events

- How COBRA continuation works for employees and dependents

- Key compliance deadlines and employer responsibilities

- The risks of non-compliance—and how to avoid them

Whether you’re navigating a recent employee separation or planning ahead to stay compliant, this guide will give you the clarity and support your business needs.

COBRA Explained: How It Works And Who Qualifies

Consolidated Omnibus Budget Reconciliation (COBRA) is a federal law that provides group health continuation for eligible employees and their dependents for a limited time. All employers with 20 or more employees that offer group health plans are required to comply and offer COBRA coverage. The terms of the plan do not change. However, the employee generally has to pay the full monthly premium.

Understanding COBRA Qualifying Events

Employees may be eligible for COBRA coverage after a specific qualifying event. Dependents may also be eligible under different circumstances.

For Employees

- Voluntary or involuntary job loss, as long as it’s not due to gross misconduct

- Reduction in work hours, which causes a loss of eligibility for the group health plan

For Dependents

- Divorce or legal separation from the covered employee

- Death of the covered employee

- Employee becomes Medicare-eligible

- A child ages out of the group health plan’s coverage (typically at age 26)

In any of these cases, COBRA ensures there is no immediate loss of coverage, giving employees and their families critical time to find alternative healthcare coverage.

How COBRA Works for Employees

After a qualifying event, eligible individuals may choose to continue their group health coverage for a limited time. It’s usually between 18 to 36 months, depending on state law and the nature of the qualifying event.

There are a few key points that employees must understand when continuing health benefits after termination or another qualifying event.

- Duration: Generally 18 months. It is extendable to 36 months for secondary events like divorce, death or Medicare entitlement. In New York, small employers under mini‑COBRA may offer up to 36 months of coverage on fully insured plans

- Cost: COBRA participants generally pay the full premium for the coverage plus an administrative fee of up to 2%. The coverage may cost more than when they were employed, as the cost is no longer being subsidized.

- Election window: Employees have a 60-day window to decide whether to elect COBRA coverage, starting either from the date coverage ended or the date they received the COBRA election notice.

- Coverage: COBRA coverage is identical to what the employee had before the qualifying event, including access to the same network, copays, and deductibles.

For many, COBRA serves as a bridge while they secure a new job or enroll in another health plan, such as through a spouse or the Health Insurance Marketplace.

Why COBRA Compliance Is Critical for SMBs

COBRA compliance is legally required, with specific, non-negotiable notice deadlines and serious financial risk for non-compliance.

Employers must:

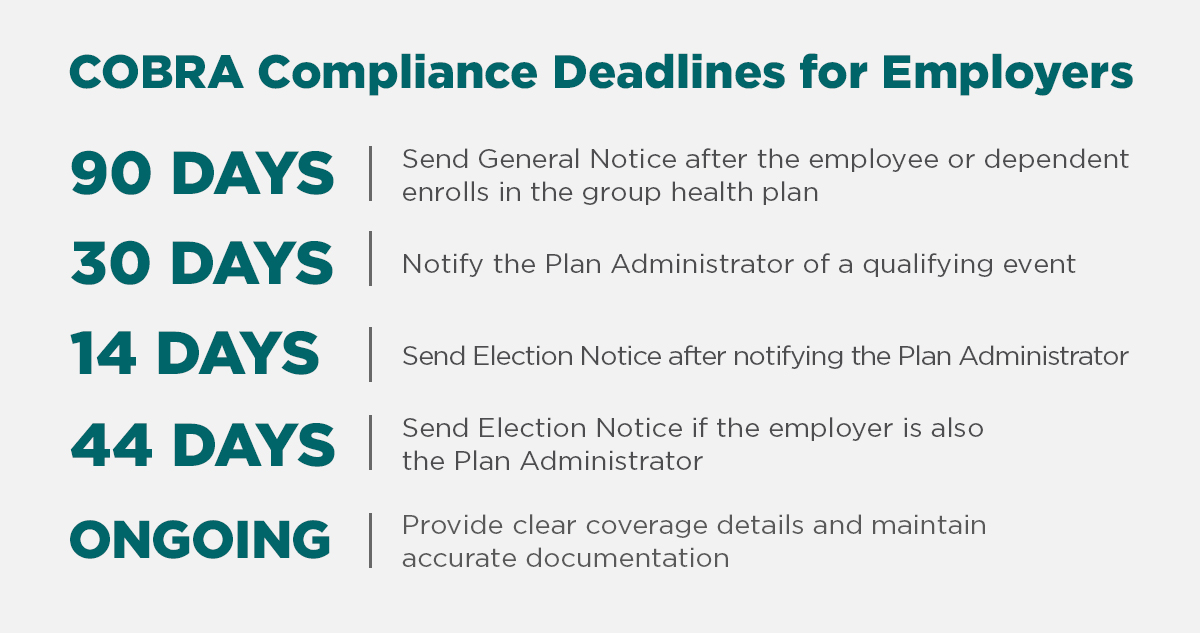

- Send the General COBRA notice within 90 days of an employee (or dependent) enrolling in the group health plan.

- Notify the Plan Administrator within 30 days of a qualifying event (e.g., termination, reduced hours).

- Ensure the Election Notice is sent within:

- 14 days after notification to the Plan Administrator, or

- 44 days total when the employer is also the administrator.

- Provide clear details on coverage length, cost, and how to enroll, and meticulously manage documentation and deadlines.

- Even a single missed deadline, like sending a notice late or including incorrect information, can lead to unnecessary penalties without proper oversight:

- IRS excise tax (~$100/day per person; $200/day per family)

- ERISA fines (up to $110/day per person)

- Plus minimum penalties and cumulative caps based on plan size.

For growing SMBs without dedicated HR/legal infrastructure, staying on top of these deadlines while ensuring compliance is extremely challenging. Any oversight (missed/late notices, miscommunication) can result in costly audits, fines from the DOL or IRS, and lawsuits from former employees.

How PrestigePEO Helps SMBs Navigate COBRA Coverage

COBRA compliance can be complex, but PrestigePEO makes it simple. We manage COBRA administration and compliance on behalf of SMBs. Our team ensures that proper notifications are delivered on time and all required deadlines are met, removing the risk of missed steps that could result in fines or legal challenges.

This reduces the burden on internal HR teams, allowing employers to focus on their core operations with confidence.

How employers benefit:

- Full COBRA administration and compliance oversight

- Automated notifications to eligible individuals

- Accurate tracking of timelines and documentation

- Expert guidance on requirements and best practices

- Reduced administrative burden on internal teams

PrestigePEO acts as a trusted partner, helping businesses remain compliant while supporting employees through coverage transitions.

Why COBRA Matters and Why SMBs Need the Right Support

For SMBs, navigating compliance requirements such as COBRA plays a crucial role in ensuring continuous health coverage. Properly managing COBRA helps avoid compliance risks and supports employee well-being. A trusted partner like PrestigePEO helps SMBs remain compliant while protecting their business and demonstrating a commitment to supporting employees during key life transitions.

Ready to Simplify COBRA Compliance?

COBRA compliance is necessary, but it doesn’t have to be overwhelming.

If you’re an employer looking for expert COBRA support, PrestigePEO can help. Our team handles the administrative and regulatory details, allowing you to stay focused on growing your business.

Contact PrestigePEO today to learn more about how we can support your COBRA, Employee Benefits and HR needs.